When you think of warehouses, you might picture rows of shelves in a big building. But the biggest warehouse company in the world doesn’t just store boxes-it moves entire economies. It’s not a traditional logistics firm. It’s not a family-owned distribution center. It’s Amazon. And its warehouse network isn’t just big-it’s the most complex, data-driven, and scalable system ever built.

Amazon’s Warehouse Network Is Bigger Than Most Countries

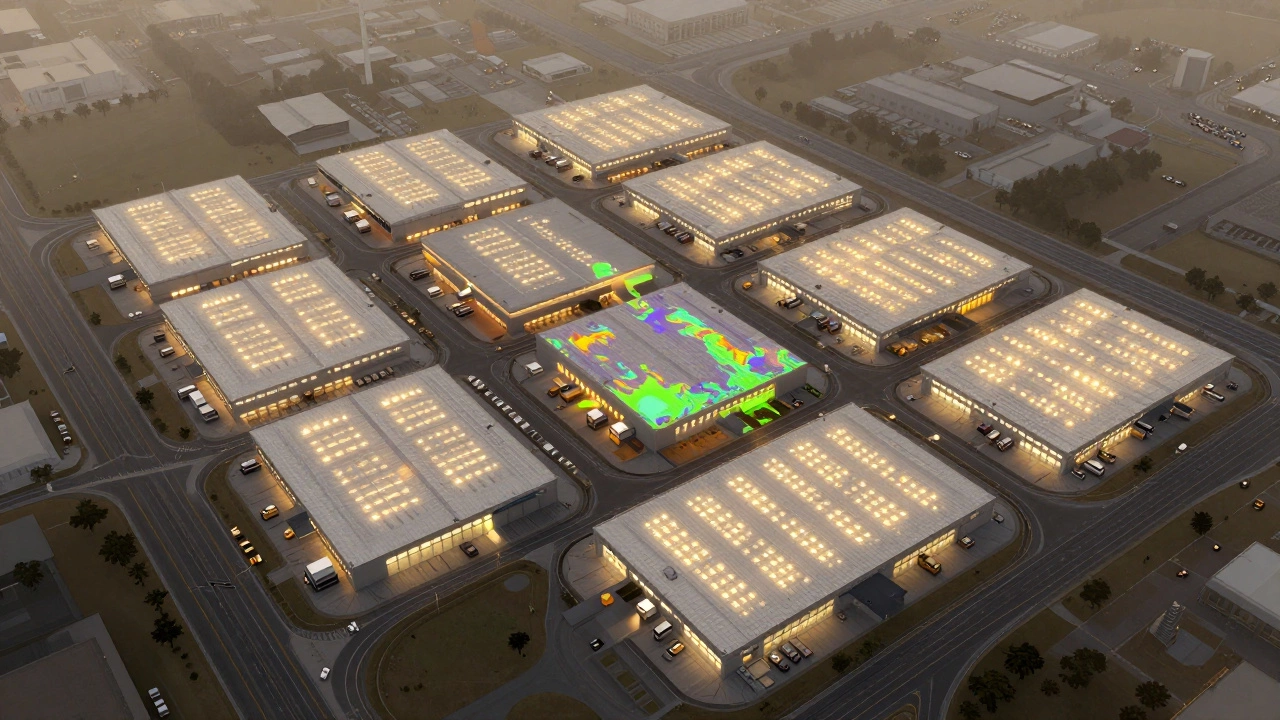

Amazon operates more than 1,100 fulfillment centers worldwide as of 2025. That’s not just a lot of buildings-it’s over 200 million square feet of warehouse space. To put that in perspective, that’s more than 3,500 American football fields covered in storage racks, robots, and workers. No other company comes close. The next largest, DHL, has around 400 facilities. Prologis, the biggest real estate owner of warehouses, leases space to many companies-including Amazon-but doesn’t operate them directly.

Amazon’s warehouses aren’t just large; they’re strategically placed. Nearly every major metro area in the U.S., Canada, Europe, and Asia has at least one. Some cities have multiple. In the U.S. alone, Amazon has fulfillment centers within 10 miles of 90% of the population. That’s why you can get a package delivered in one day-or even the same day-without paying extra.

How Amazon’s Warehouses Work Differently

Most warehouses are designed to store things for months. Amazon’s are built to move things in hours. Their system is called fulfillment, not storage. A product might arrive at a center in the morning and ship out to a customer by nightfall. That speed comes from automation, machine learning, and real-time tracking.

Each center uses robots to bring shelves to human workers instead of making people walk miles to find items. AI predicts what products will be ordered next and places them closer to packing stations. If you buy a phone case in New York, it might come from a warehouse in Ohio-but only after the system decided it was the fastest option based on traffic, weather, and delivery routes.

Amazon doesn’t just store its own products. Millions of third-party sellers use Amazon’s warehouses through FBA (Fulfillment by Amazon). That means a small business in Texas can ship products to Amazon’s center in Georgia, and Amazon handles storage, packing, shipping, returns, and customer service. This turns Amazon into both a retailer and a logistics provider.

Who Else Is in the Game?

While Amazon leads by a huge margin, other players exist in the global warehouse space.

- Prologis owns and leases warehouse space to companies like Amazon, FedEx, and Walmart. It’s the largest real estate company in the sector, but it doesn’t run the operations.

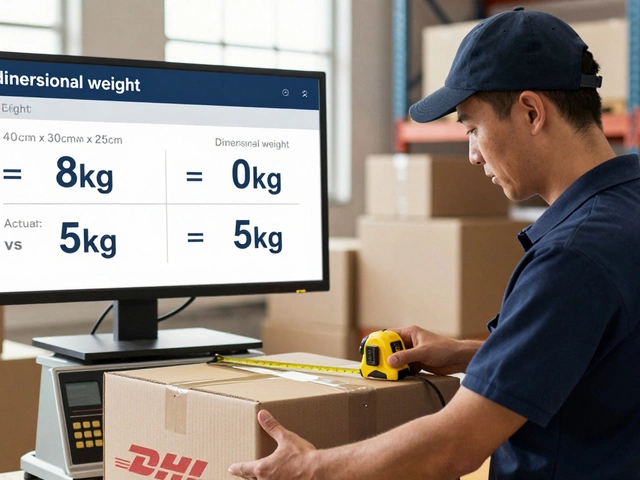

- DHL Supply Chain operates about 400 facilities and handles warehousing for big brands like Nike and Dell. It’s strong in Europe and Asia but lacks Amazon’s scale in the U.S.

- FedEx Supply Chain runs over 200 centers, mostly for retail and healthcare clients. It’s reliable but not designed for same-day delivery.

- Walmart has over 150 fulfillment centers and is expanding fast-but it’s mostly for its own stores and online orders.

None of these companies come close to Amazon’s combination of size, speed, and integration. Amazon doesn’t just rent space-it owns the entire process from inventory to delivery.

Why Size Matters in Warehousing

Big isn’t just about square footage. It’s about efficiency. The bigger the network, the smarter the system becomes. Amazon’s warehouses feed data into a central AI that learns from every order. If a product sells out in Chicago, the system checks inventory in Detroit, Milwaukee, and St. Louis-and reroutes stock before the next order comes in.

This scale also lowers costs. Amazon can negotiate better rates with trucking companies because it moves millions of packages a day. It can afford to invest in robotics because the return on investment kicks in faster at this volume. Smaller companies can’t match that.

For businesses, using Amazon’s network means skipping the need to build or lease their own warehouses. For consumers, it means faster, cheaper delivery. For competitors, it means playing catch-up with a system that’s always learning and improving.

The Hidden Costs of Being the Biggest

Amazon’s dominance isn’t without controversy. Critics point to labor conditions, environmental impact, and market power. Its warehouses employ over 750,000 people globally, many working under high-pressure quotas. Unionization efforts have grown in recent years, especially in the U.S. and Europe.

Environmental concerns include energy use and packaging waste. Amazon has pledged to reach net-zero carbon by 2040 and uses electric delivery vans in some cities. But with 10 billion packages shipped annually, the footprint is massive.

Regulators in the U.S., EU, and UK are watching closely. Some are pushing for rules that would force Amazon to separate its marketplace from its logistics arm. If that happens, the company might have to spin off its fulfillment network-which could change the entire landscape.

What Does This Mean for Small Businesses?

If you run an online store, Amazon’s scale is both a gift and a challenge. On one hand, FBA lets you compete with big brands without investing in your own warehouse. You get access to Prime customers, fast shipping, and easy returns.

On the other hand, you’re dependent on Amazon’s rules, fees, and algorithms. If your product gets buried in search results or Amazon decides to sell a similar item under its own brand, you can lose sales overnight. Many sellers now use multi-channel fulfillment-shipping from Amazon’s warehouses but also selling on Shopify, Walmart, and Etsy to reduce risk.

The key is to understand the trade-off: convenience and speed versus control and independence.

The Future of Warehousing

Amazon isn’t slowing down. It’s building automated centers with fewer human workers and more AI-driven sorting. It’s testing drone delivery in rural areas and experimenting with underground warehouses in cities to save space.

Other companies are trying to catch up. Walmart is investing in robotics. Alibaba’s Cainiao is expanding in Southeast Asia. But none have the same level of integration between retail, logistics, and data.

The biggest warehouse company in the world isn’t just a building-it’s a system. And that system is reshaping how goods move across the planet. Whether you love it or hate it, Amazon’s warehouse network is now the standard everyone else measures against.

Is Amazon really the biggest warehouse company in the world?

Yes. Amazon operates over 1,100 fulfillment centers globally, totaling more than 200 million square feet of space. No other company-whether DHL, Prologis, or FedEx-comes close in terms of owned and operated warehouse volume or daily throughput.

What’s the difference between a warehouse and a fulfillment center?

A traditional warehouse stores goods for long periods, often for months or years. A fulfillment center is designed for fast turnover-items arrive, get picked, packed, and shipped out within hours or days. Amazon’s centers are fulfillment centers, not storage facilities.

Does Amazon own all its warehouses?

Most of Amazon’s fulfillment centers are owned by Amazon. But it also leases space in some locations, especially in urban areas where land is expensive. Even when leased, Amazon controls the operations, technology, and staffing.

Can other companies compete with Amazon’s warehouse network?

It’s extremely difficult. Amazon’s scale, automation, and data systems create a feedback loop: more volume → better efficiency → lower costs → more customers. Competitors like Walmart and Alibaba are investing heavily, but they’re years behind in both infrastructure and AI integration.

What is Fulfillment by Amazon (FBA)?

FBA is a service where third-party sellers send their products to Amazon’s warehouses. Amazon then handles storage, packing, shipping, returns, and customer service. Sellers pay fees but gain access to Prime shipping and Amazon’s massive customer base.