Startup Cost: A Practical Guide to Budgeting Your New Business

Starting a business feels exciting, but the moment you think about money it can get overwhelming. Knowing exactly what you need to spend before you open the doors saves you stress and prevents nasty surprises. This guide breaks down every type of startup cost and shows you how to keep the numbers under control.

Key Categories of Startup Cost

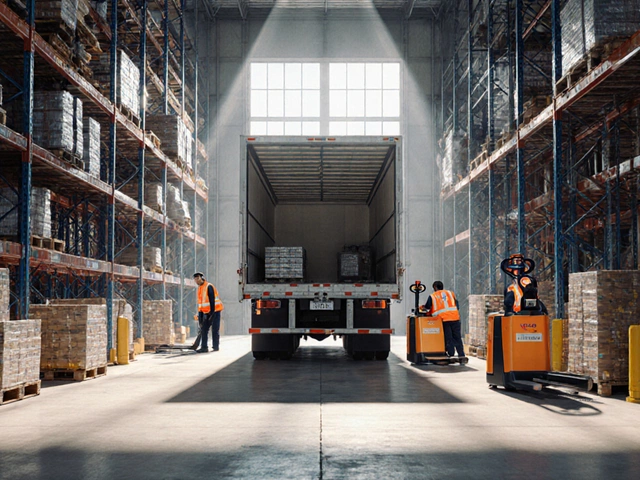

Almost every new venture has a few common expense buckets. First, equipment and tools – the trucks, forklifts, computers, or sewing machines you’ll need to do the job. Second, licensing and permits. Whether you’re registering a limited company or applying for a road‑hazard licence, those fees add up quickly.

Third, rent or lease. Even if you work from a garage, you’ll likely pay for a storage unit or a small office. Fourth, staff wages. Hiring drivers, packers, or admin support means budgeting for salaries, taxes, and insurance. Fifth, marketing. A simple website, local flyers, and online ads are essential to attract your first customers.

Sixth, insurance and safety. A removal business, for example, needs vehicle insurance, public liability, and cargo coverage. Finally, working capital – cash set aside for utilities, fuel, or unexpected repairs during the first few months.

Tips to Keep Your Startup Budget Tight

1. List every item before you spend. Use a spreadsheet with columns for description, estimated cost, actual cost, and notes. Seeing the numbers side‑by‑side helps you spot duplicates or unnecessary items.

2. Prioritize cash‑flow needs. Equipment that can be leased or bought second‑hand often costs less upfront. Start with the basics and upgrade once you have revenue.

3. Shop around for insurance. Get quotes from three providers and ask about bundling discounts. Small tweaks in coverage limits can shave hundreds off your yearly premium.

4. Start marketing cheap. Leverage free social media platforms, ask satisfied customers for reviews, and post in local community groups. A modest budget for targeted ads can still bring a steady stream of inquiries.

5. Build a safety net. Aim to have at least three months of operating expenses saved. This buffer covers slow periods and prevents you from borrowing at high interest.

6. Track every transaction. Use a simple accounting app to record invoices and receipts daily. Accurate records make tax time painless and help you refine future budgets.

7. Review and adjust monthly. Compare your estimates with actual spend. If a line item is consistently over or under, tweak the budget right away rather than waiting until year‑end.

By following these steps you’ll create a realistic startup cost picture and avoid the common pitfall of under‑funding. Remember, the goal isn’t to spend less—it’s to spend smart so your business can grow without being held back by cash problems.

Whether you’re launching a removal service, an online shop, or a coffee stall, the same principles apply. Define the categories, estimate honestly, protect yourself with insurance, and keep a cash reserve. With a solid budget in place, you can focus on delivering great service and watching your new venture thrive.

May 9, 2025

Evelyn Wescott

0 Comments

Ever wondered what it actually takes to start Amazon logistics? This article breaks down the real costs, points out often-missed expenses, and shares practical tips for getting started. Whether you’re curious about how Amazon’s DSP program works, or if you’re ready to dive in, you’ll find up-to-date numbers, potential earnings, and honest facts from 2025. We’ll also flag common pitfalls and smart ways to save. Think of this as your realistic guide to launching an Amazon logistics business.